The solar tax credit, also known as the investment tax credit (ITC), is a federal tax credit that allows homeowners and businesses to deduct a portion of the cost of installing a solar energy system from their federal income taxes. The solar tax credit was created to encourage the adoption of renewable energy sources and to help offset the initial cost of installing a solar energy system. In this article, we will discuss the solar tax credit and how many years it can be rolled over.

Overview of the Solar Tax Credit

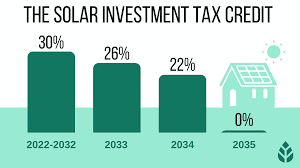

The solar tax credit was first introduced in 2006 and has been extended multiple times. The credit is currently set to begin phasing out in 2023 and will be completely phased out for residential systems in 2024. For commercial systems, the credit will be reduced to 10% in 2024 and beyond.

The solar tax credit is equal to 26% of the cost of a solar energy system installed on a residential or commercial property. The credit can be applied to both the cost of the solar panels and the cost of installation. For example, if the total cost of a solar energy system is $20,000, the solar tax credit would be $5,200 (26% of $20,000).

Rolling Over the Solar Tax Credit

One of the most significant benefits of the solar tax credit is that it can be rolled over to future tax years if the credit exceeds the taxpayer’s liability in the current year. This means that if a taxpayer cannot use the entire credit in the year that the solar energy system is installed, they can carry the remaining credit forward to future tax years.

The solar tax credit can be rolled over for up to five years. For example, if a taxpayer installs a solar energy system in 2023 and the solar tax credit is $5,000, but they only have a tax liability of $4,000 for that year, they can roll over the remaining $1,000 credit to future tax years. They can use the $1,000 credit in 2024, 2025, 2026, 2027, or 2028, as long as they have a tax liability in those years.

It’s important to note that the solar tax credit cannot be rolled back to previous tax years. In other words, if a taxpayer did not use the entire credit in the year that the solar energy system was installed, they cannot go back and apply the remaining credit to a previous year’s tax liability.

Using the Solar Tax Credit for Multiple Properties

Another benefit of the solar tax credit is that it can be used for multiple properties. For example, if a taxpayer installs a solar energy system on their primary residence and the credit exceeds their tax liability, they can roll over the remaining credit to future tax years. If the taxpayer purchases a second home or installs a solar energy system on a rental property, they can use the remaining credit for those properties as well.

Conclusion

In summary, the solar tax credit is a federal tax credit that allows homeowners and businesses to deduct a portion of the cost of installing a solar energy system from their federal income taxes. The credit is currently set to begin phasing out in 2023 and will be completely phased out for residential systems in 2024. For commercial systems, the credit will be reduced to 10% in 2024 and beyond.

The solar tax credit can be rolled over for up to five years if the credit exceeds the taxpayer’s liability in the current year. This means that if a taxpayer cannot use the entire credit in the year that the solar energy system is installed, they can carry the remaining credit forward to future tax years. The solar tax credit cannot be rolled back to previous tax years.